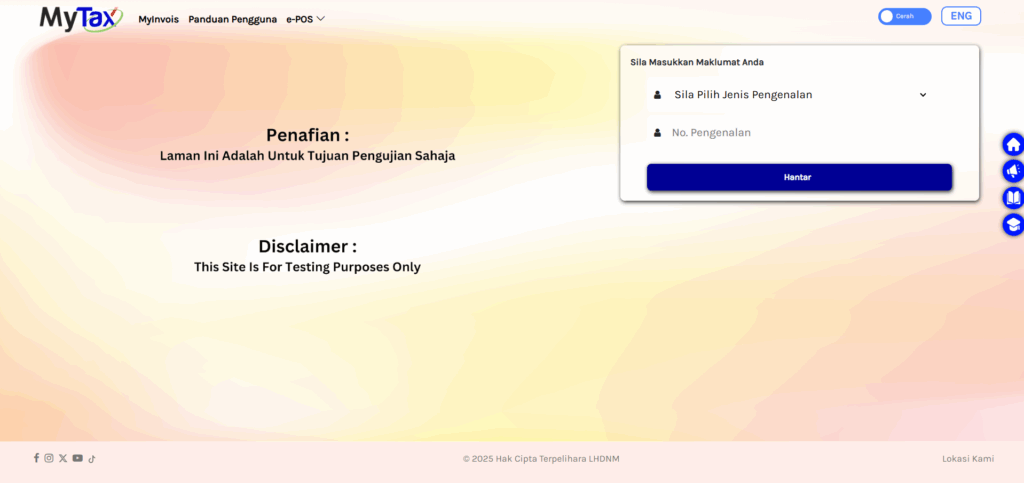

You can use this Sandbox MyTax: https://preprod-mytax.hasil.gov.my/ (this site is for testing purpose) before started use e-invoice. Log in to this link and follow the tutorial below.

Or you can use production MyTax: https://mytax.hasil.gov.my/

First time user

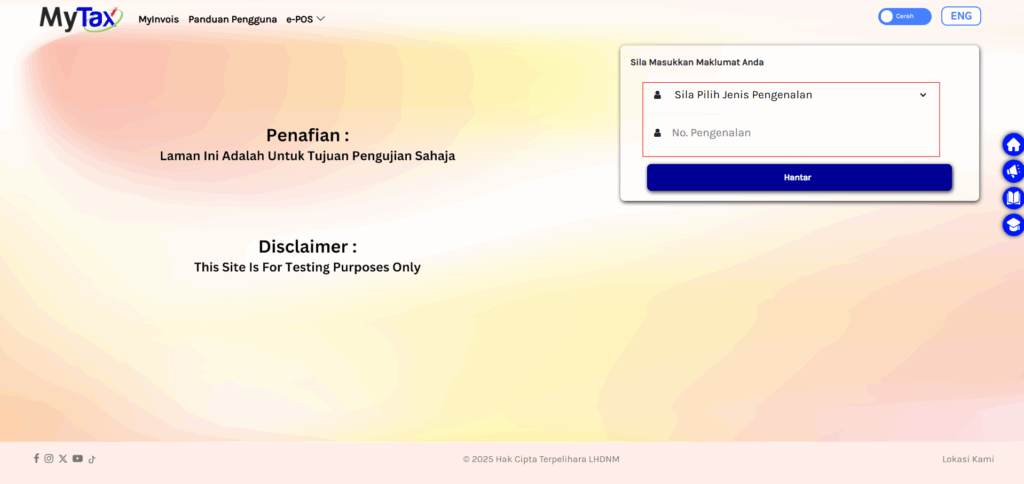

Select your type of identification and fill in identification number. Then press “Hantar”.

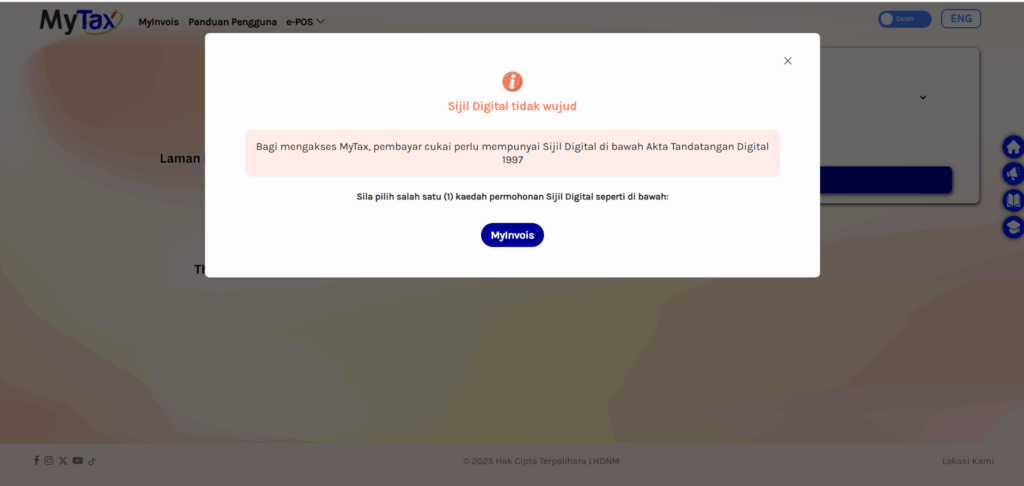

To access MyTax, taxpayers need to have a Digital Certificate under the Digital Signature Act 1997. Click “MyInvois”.

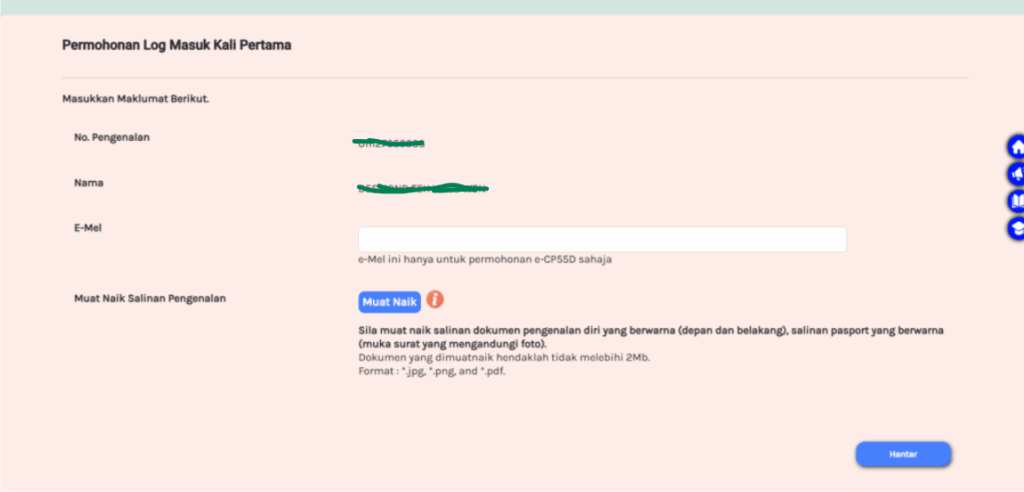

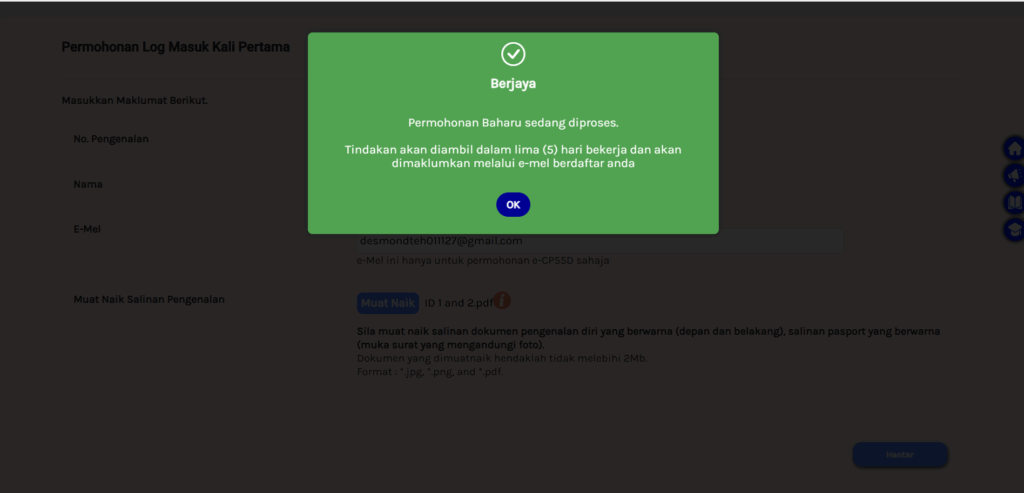

Fill in your email address and upload a picture of the front and back of your identity card. Click “Hantar”.

Click “OK”.

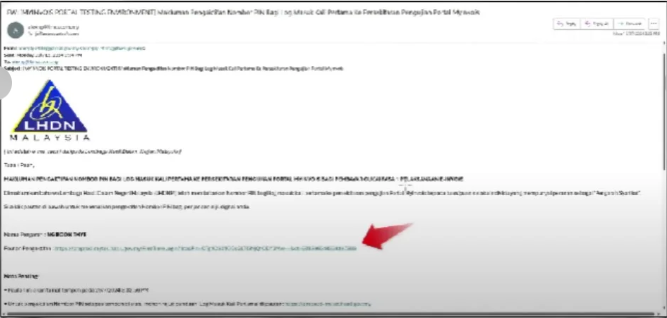

After that, when you open your email, you will receive an email from LHDN. Now just click on the activation link to activate it.

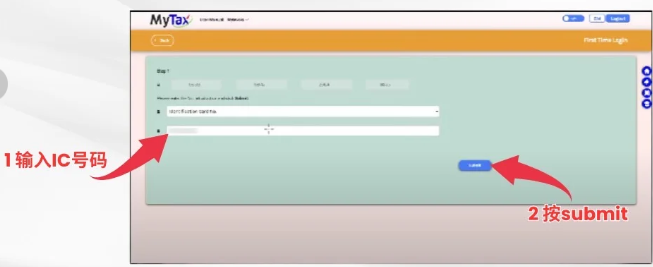

Then you will be redirected to the My Tax portal. You need to fill in the IC number you just entered and click “Submit”.

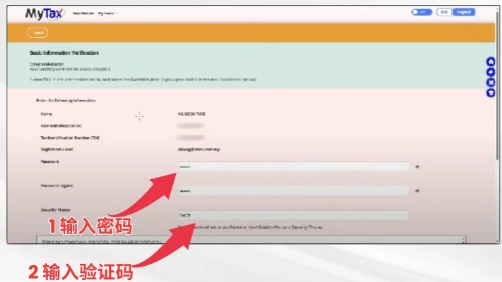

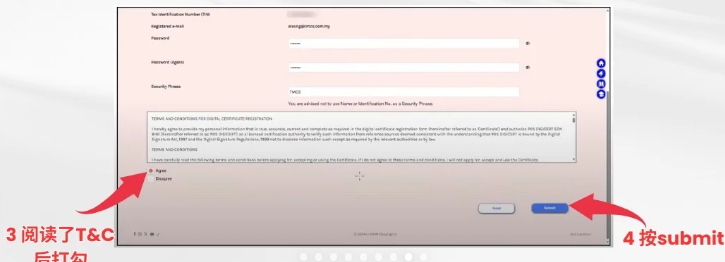

On this page, you need to create a password, which is the password for logging into MyTax Portal. Then check “I agree T&C” and click submit.

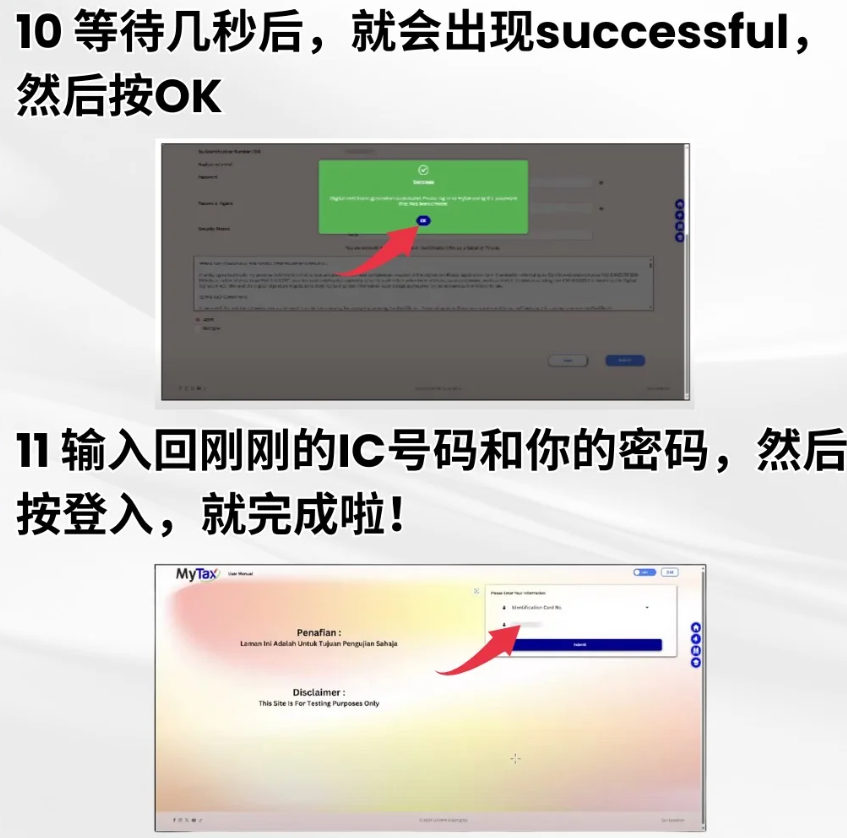

Wait for a few seconds and then successfully will appear and press OK. Then, enter the IC number and password you just entered, then click Login to complete.

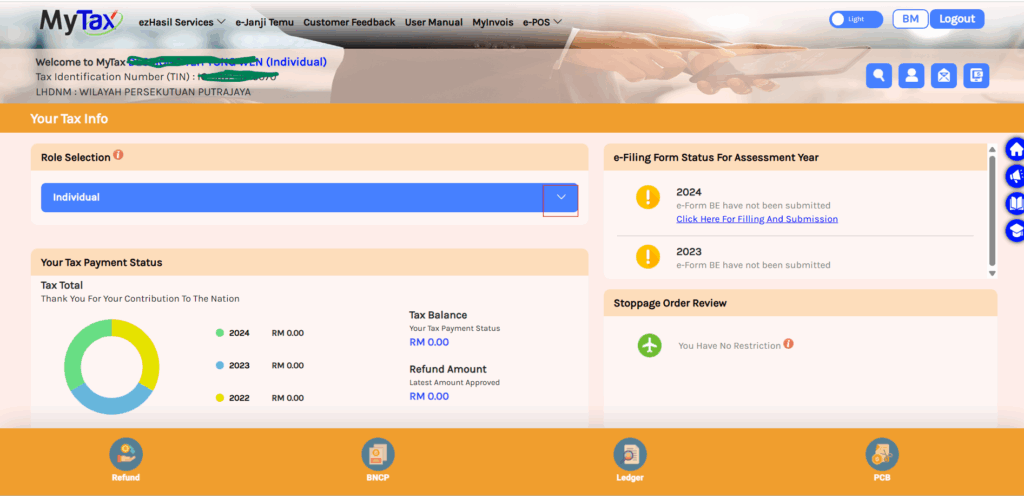

Login to MyTax Portal, you will see this screen. Then, you click “MyInvois”.

How to register a company to issue electronic invoices

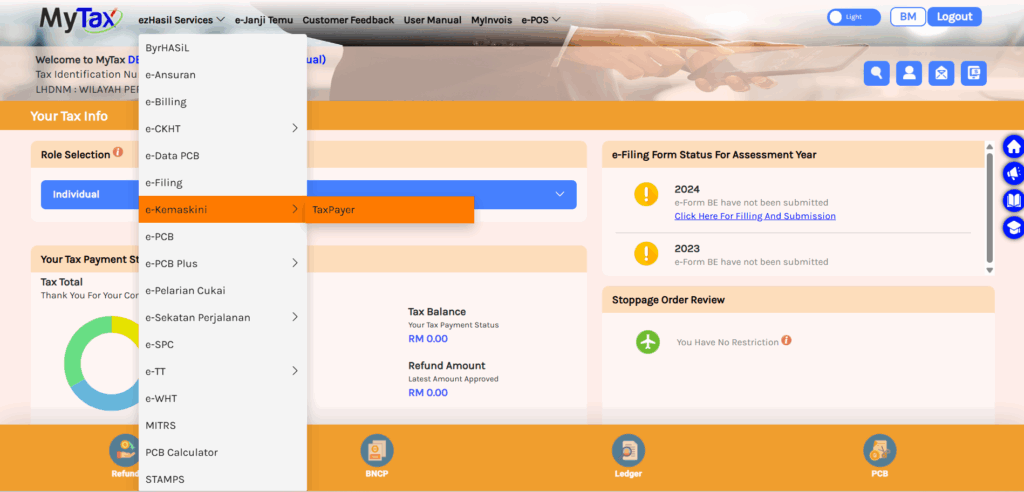

On the MyTax page, select ezHasil Services, and then click e-Kemaskini -> Tax Payer.

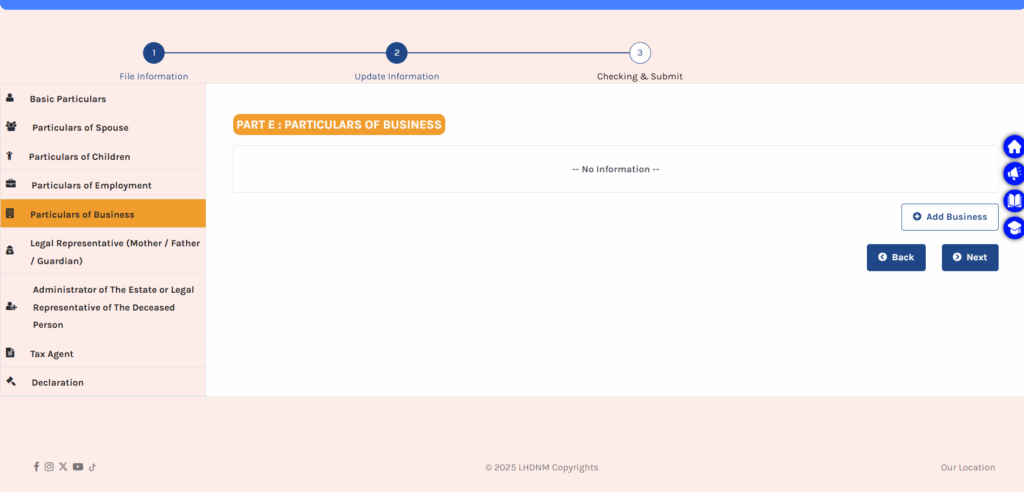

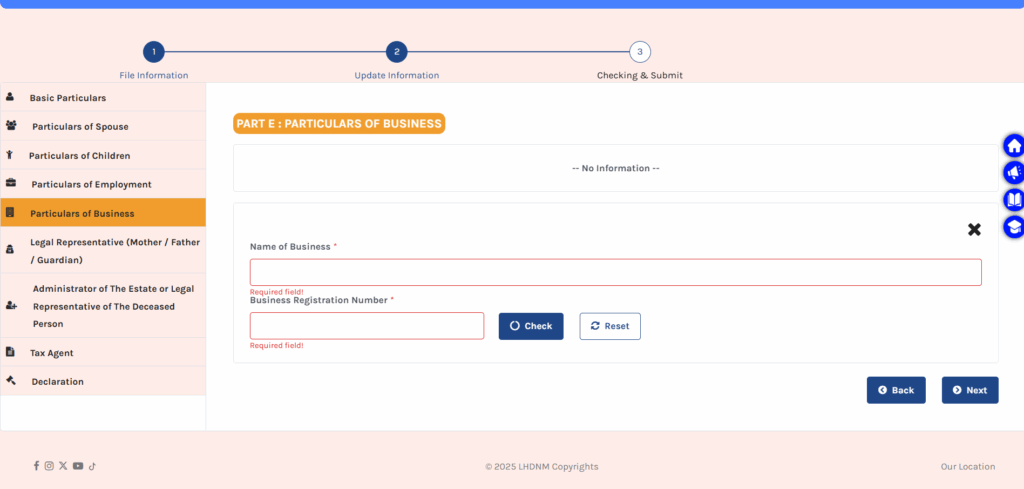

On the e-Kemaskini Individual page, select Particulars of Business -> Add Business.

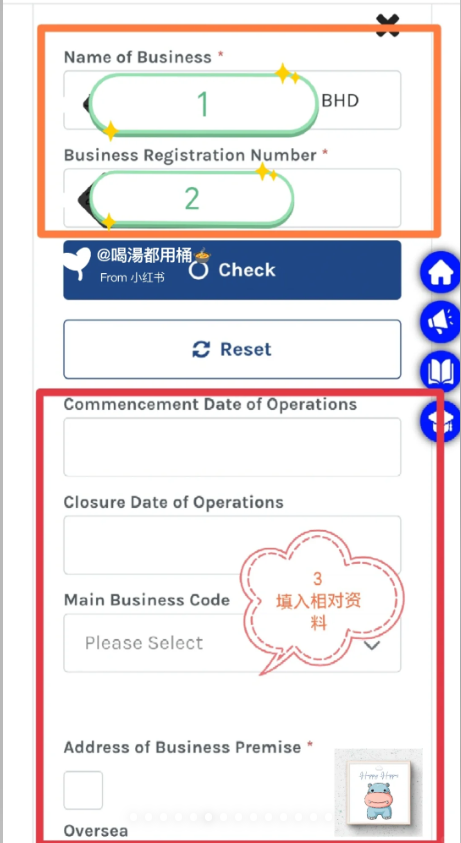

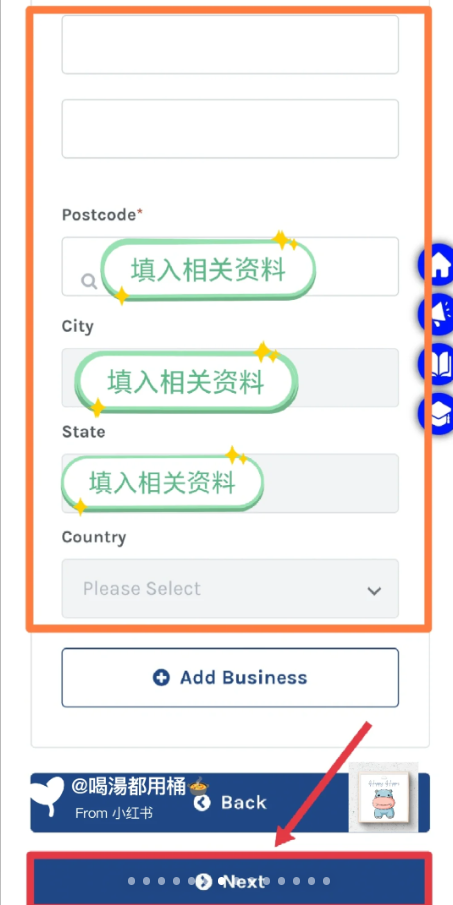

Go to Part E, enter your company name and Business Registration Number (refer to SSM) and click Check. The system will ask you to fill in the company registration information. After the information is entered, click Update.

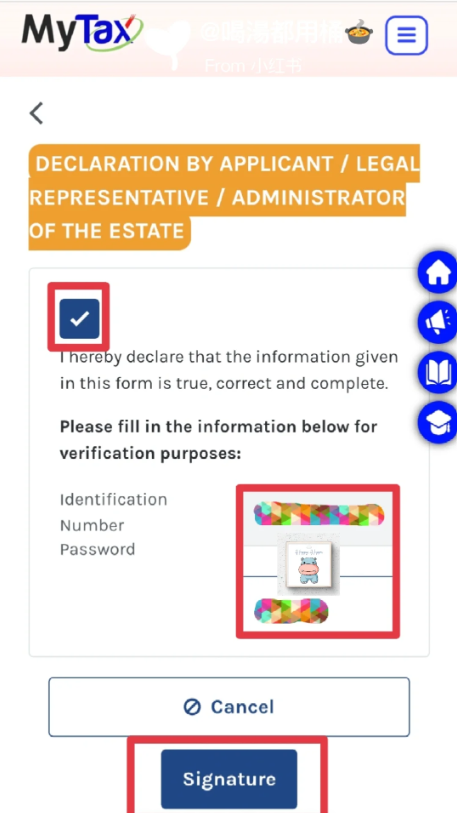

After completing the data update , the List of New Business will be displayed. Please continue to click Next, Next, Next until you sign the personal declaration part. Tick ☑️, enter IC, Password and submit to upload to the system.

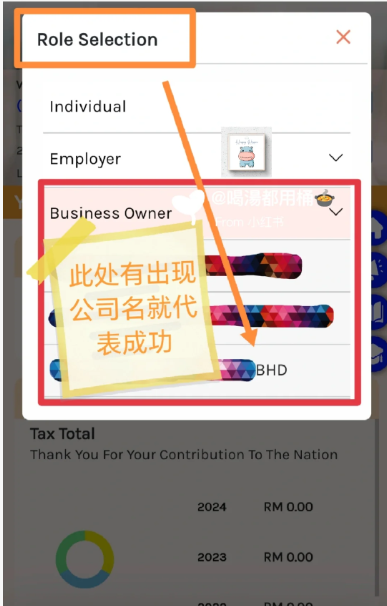

After signing the personal statement, click back to the profile page, select Role Selection in the middle, then select Business Owner and check if the newly added company is displayed. If it is displayed, it means the update was successful. (If not, please log out and log in again to check)

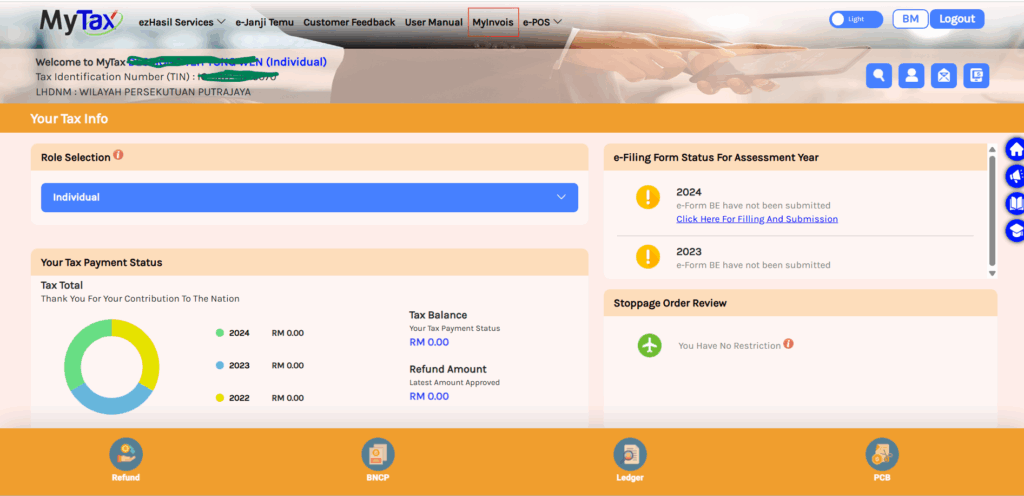

After completing the above steps, you can click MyInvois to log in to your account.

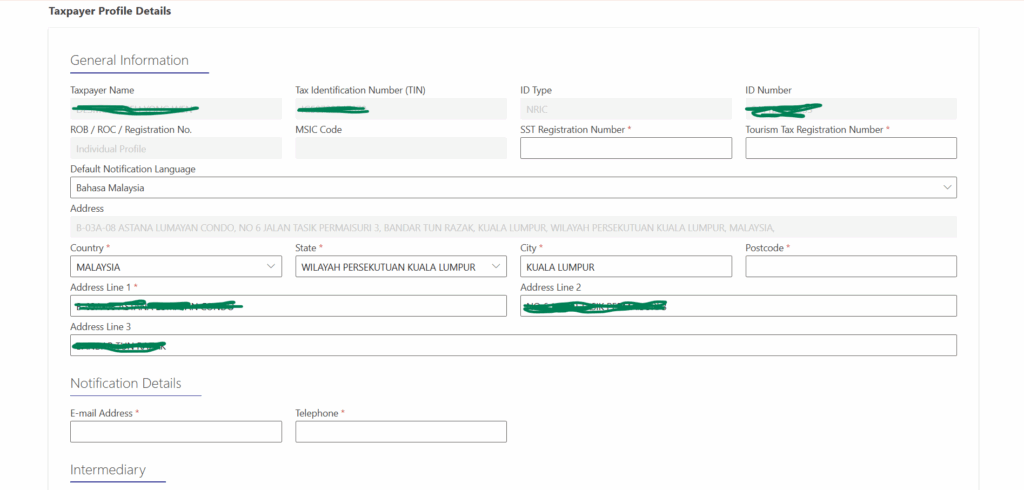

When using for the first time, you must fill in your SST registration number and Tourism Tax Registration Number.

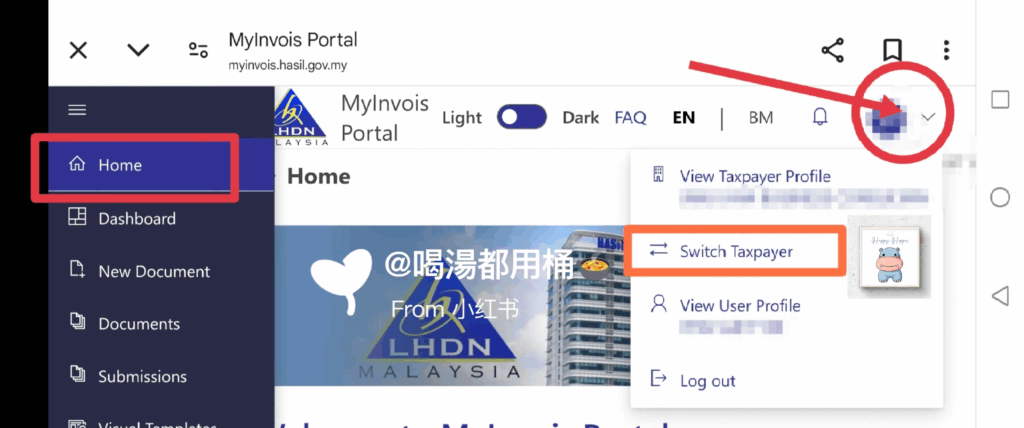

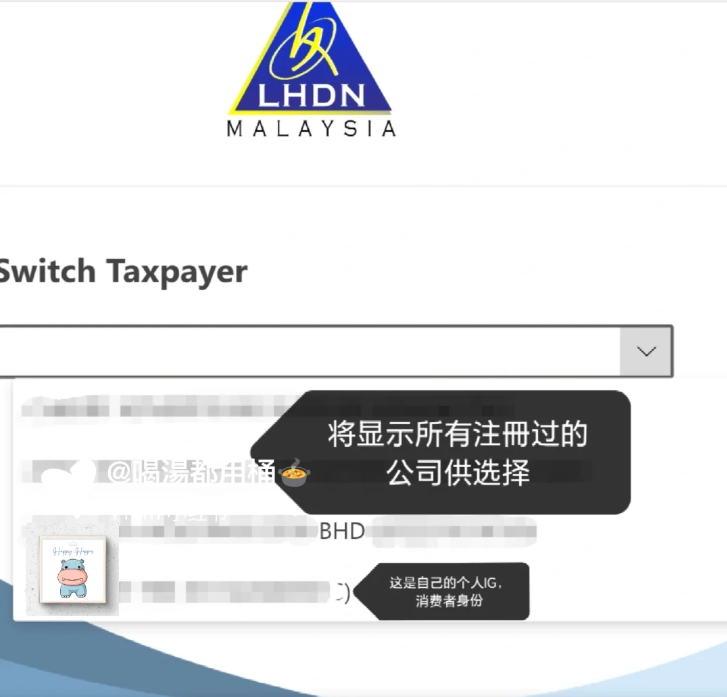

Click the blue circle in the upper right corner of the My Invois system to change the Taxpayer user representative. You can register multiple company accounts or personal accounts.

*If the Switch Taxpayer does not display/cannot select the company, the system will update and display the company information in the My Invois App within 24 hours.

How to Obtain Client ID and Client Secret on MyInvois Portal

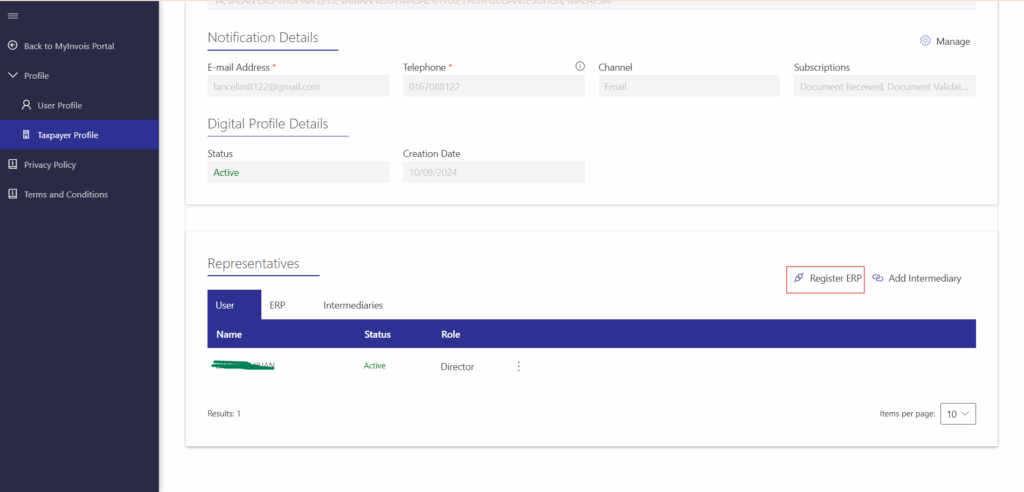

- On the top-right corner of the MyInvois Portal, locate the profile dropdown menu.

- From the options available, choose “View Taxpayer Profile” to access the taxpayer’s profile.

- This step grants you access to view the taxpayer’s profile information

*If the profile is wrong, you may click Switch Taxpayer, and from there you select which entity, we are talking about tax profile which tax entity that you want to actually select and to actually proceed to grant access to system. If the profile is correct you can click “View Tax Payer Profile”.

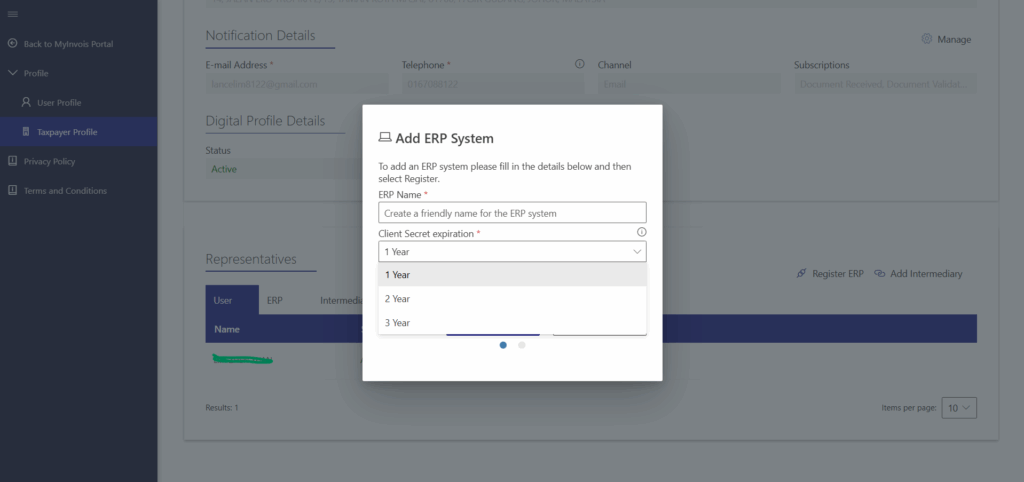

Click “Register ERP”.

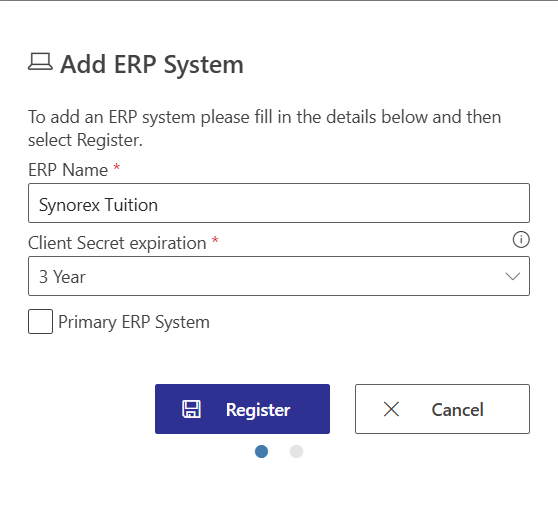

- Enter the ERP Name as needed.

- Select Client Secret expiration: 3 years.

- Click on “Save” to save the changes.

Click on “Register”.

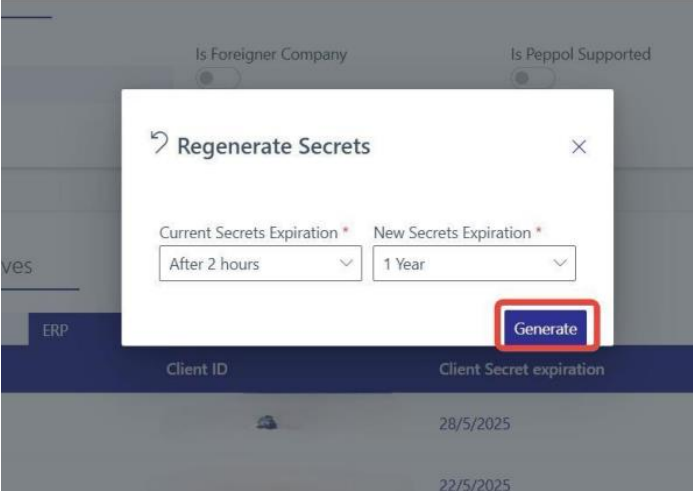

- Select the current and new Secrets Expiration time.

- Click on the “Generate” button.

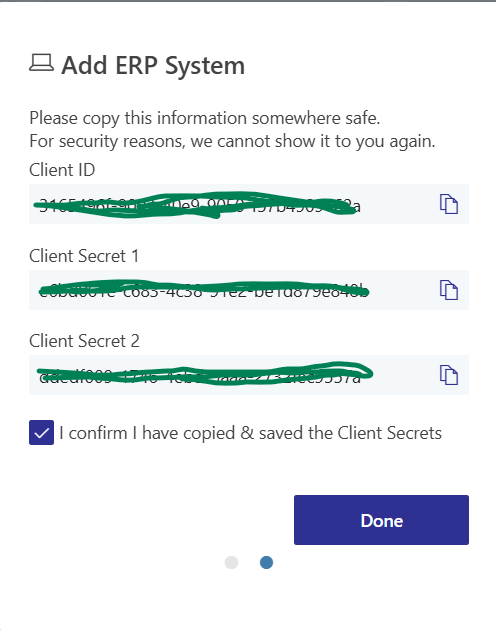

- Copy the newly displayed Client ID and Client Secret.

- Check the box to confirm that you have copied the credentials.

- Click on “Done” to complete the process.