Type URL on your web browser: https://mytax.hasil.gov.my/

Select your type of identification and fill in identification number. Then press “Hantar”.

Login to MyTax Portal, you will see this screen. Then, you click “MyInvois”.

- On the top-right corner of the MyInvois Portal, locate the profile dropdown menu.

- From the options available, choose “View Taxpayer Profile” to access the taxpayer’s profile.

- This step grants you access to view the taxpayer’s profile information

*If the profile is wrong, you may click Switch Taxpayer, and from there you select which entity, we are talking about tax profile which tax entity that you want to actually select and to actually proceed to grant access to system. If the profile is correct you can click “View Tax Payer Profile”.

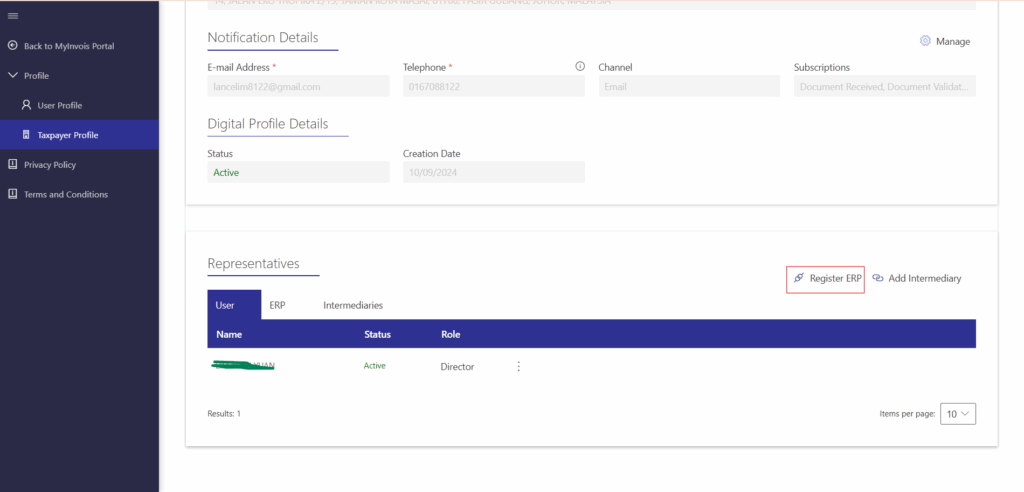

Click “Register ERP”.

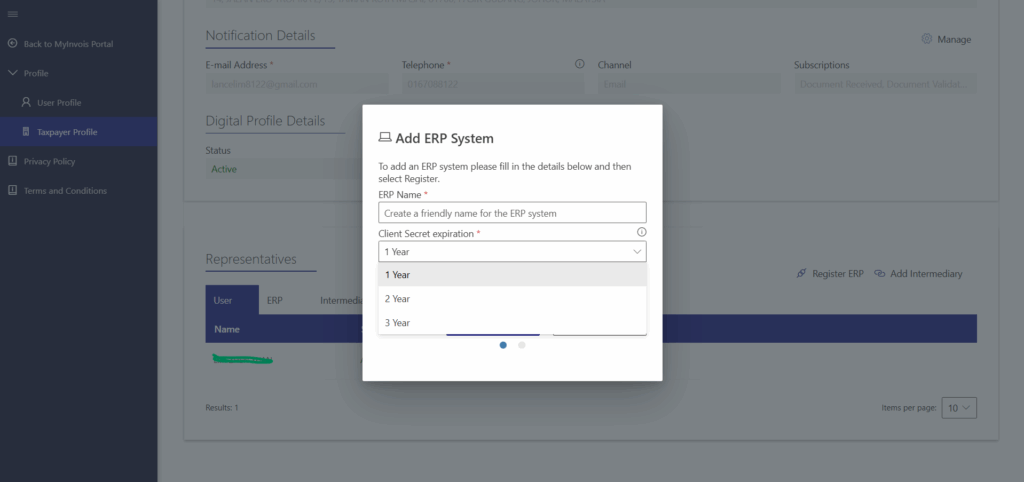

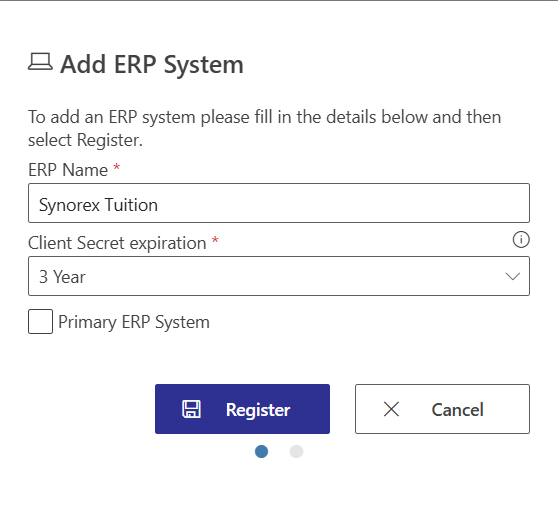

- Enter the ERP Name as needed.

- Select Client Secret expiration: 3 years.

Click on “Register”.

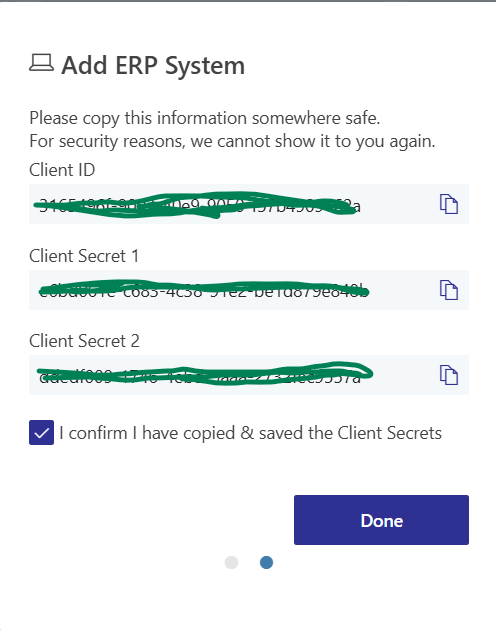

- Copy the newly displayed Client ID and Client Secret.

- Check the box to confirm that you have copied the credentials.

- Click on “Done” to complete the process.

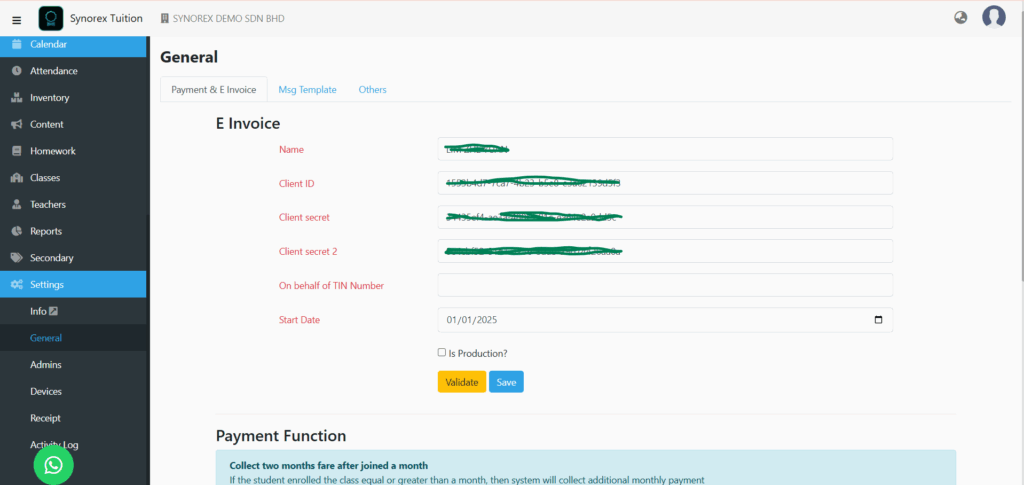

- Click Settings -> General on the left panel.

- Insert your Full Name on MyTax and copy Client ID, Client Secret and Client Secret 2 to here.

- Choose the start date you are going to use e-invoice.

Is Production = official account

You also can press “Validate” button to check if your Client ID, Client Secret, and Client Secret 2 is correct.

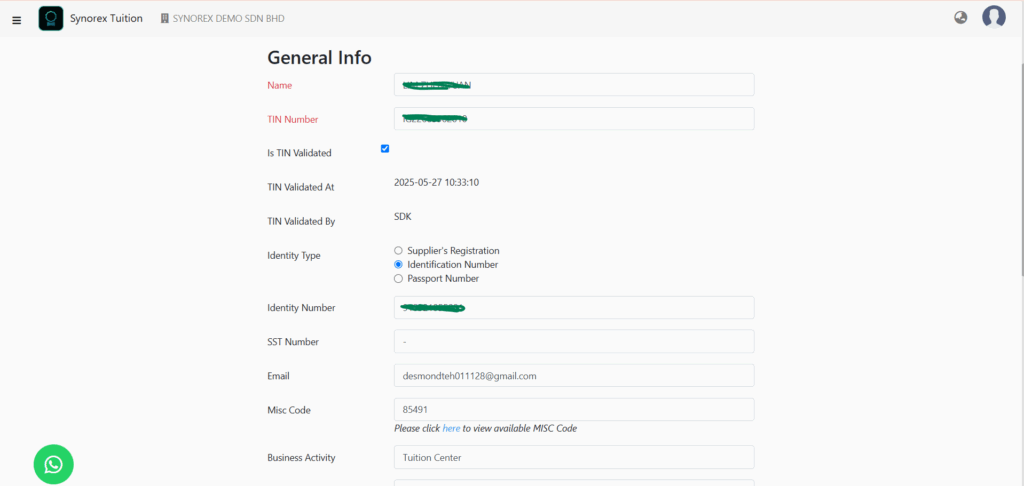

Add E-invoice information on Settings -> Info

Click Settings -> Info

Fill in all details:

- TIN Number *If your TIN Number is correct it will auto validate

- Identity Number

- MISC Code belongs to your company

- Business Activity

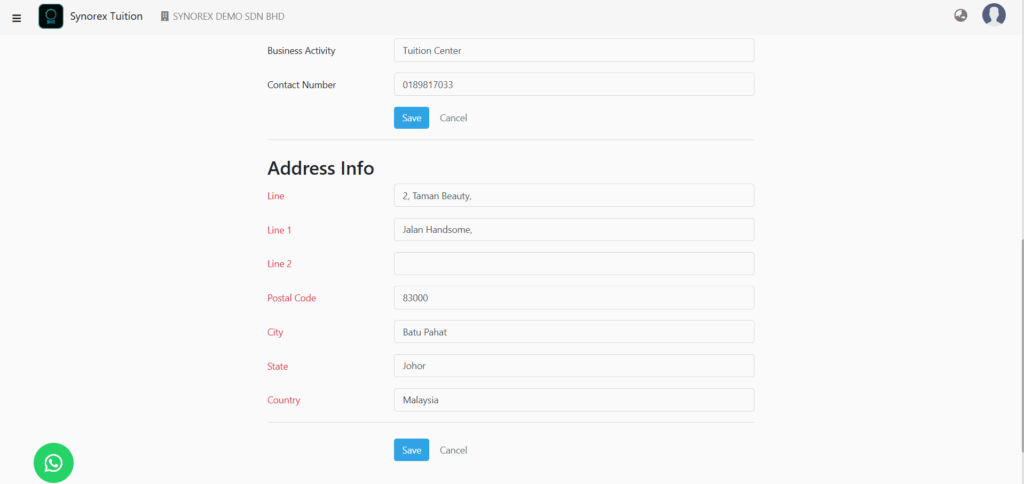

- Contact Number

- Company’s Address

Press “Save” Button.